US stocks end lower after Trump sends tariff notices to Japan, Korea. Tesla sinks

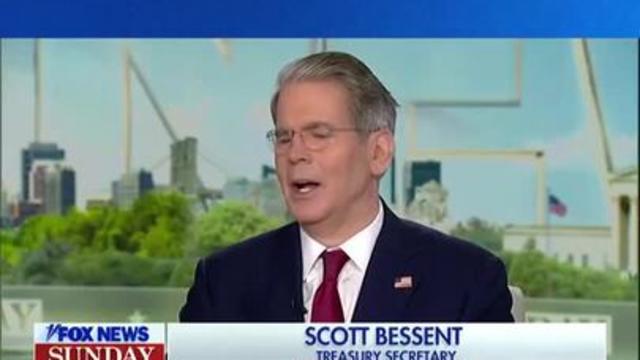

U.S. stocks closed lower after President Donald Trump said in social media posts he sent letters to Japan and Korea notifying them that their tariffs would be 25%,

The tariffs will be levied beginning Aug. 1 and will be added to any retaliatory tariffs from either nation.

The blue-chip Dow fell 0.94%, or 422.17 points, to 44,406.36; the broad S&P 500 shed 0.79%, or 49.37 points, to 6,229.98; and the tech-heavy Nasdaq dropped 0.92%, or 188.59 points, to 20,412.52. The benchmark 10-year yield rose to 4.387%.

The levies on Korea and Japan rattled investors. Although Trump moved his self-imposed tariff deadline to Aug 1 from July 9 and officials said trade deals would be finalized this week, officials also said countries would be notified by July 9 of what their tariffs would be. Korea and Japan were the first to see their levies, and investors are waiting to see how many more will come and at what levels.

Trump earlier threatened an extra 10% tariff on countries aligning themselves with the "Anti-American policies" of the BRICS group of Brazil, Russia, India, China and South Africa.

If Trump makes good on his higher tariff threats, economists say inflation could spike and the economy would slow, setting the stage for a period of what is called stagflation.

More oil supply

Oil prices initially slid after the Organization of the Petroleum Exporting Countries (OPEC) and its allies agreed to increase production by 548,000 barrels a day in August. That's larger than the 411,000 monthly increase in production in May, June and July and more than analysts' had expected. Additionally, the countries will consider adding another roughly 548,000 barrels a day in September at the next meeting on Aug. 3, according to Bloomberg, citing delegates who asked not to be identified.

Despite the cuts, Saudi Arabia raised prices for its main crude grade for Asian buyers in August by $1 to $2.20 a barrel more than the regional benchmark, exceeding expectations. That's seen as a sign Saudi Arabia believes the oil market is strong enough to withstand extra supplies that OPEC+ is adding.

Oil prices recovered their initial losses, last trading up 1.49% at $68 per barrel.

Corporate news

-

Tesla shares shed 6.79% as tensions between chief executive Elon Musk and Trump heat up again. Musk said on social media he started the "America Party" aimed at winning a handful of Senate seats and House districts that could serve as the "deciding vote" on"contentious laws," given the "razor-thin legislative margins" in Congress. Trump responded on social media by saying Musk had gone "completely off the rails," suggesting the third party was in response to Musk being angry because the spending bill eliminated incentives to buy electric cars.

-

Amazon Prime Day is slated to begin July 8. The e-commerce giant's shares inched up.

-

Oracle's cutting its database software and cloud-computing service for the government. Shares slipped 2.13%.

-

Apple iPhone sales in China grew for the first time in two years last quarter, but local rival Huawei remains on top, according to research firm Counterpoint. Apple shares fell 1.69% after Trump announced tariffs on Korea and Japan. Some Apple components come from Korea.

-

WNS shares soared 14.13% after Capgemini said it's paying $3.3 billion in cash for WNS.

-

CoreWeave said it has agreed to buy Core Scientific in an all-stock deal worth about $9 billion, or $20.40 per share. Core Scientific shares plunged 17.61%.

-

Royal Gold share dropped 6.44% after the company agreed to buy Sandstorm Gold and Horizon Copper.

Cryptocurrency

Over the weekend, an unknown individual or entity moved $8 billion worth of crypto after holding the digital assets for 14 years and originally bought for less than $210,000, media reports said. The transfer of 80,000 bitcoin reportedly came from eight dormant wallets.

Bitcoin was last down 1.09% at $108,026.60.

(This story was updated with new information.)

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at [email protected] and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday.

This article originally appeared on USA TODAY: US stocks close lower on renewed tariff worries. Tesla sinks