C3.ai, Inc. AI is doubling down on Generative and agentic AI, and the market is watching closely.

In fiscal 2025, C3.ai showcased major momentum in its Generative and agentic-AI efforts. The company reported more than 100% year-over-year growth in Generative-AI revenues, with 66 initial production deployments across 16 industries in a year. Clients include the U.S. Navy, Dow, Chanel and the Shoah Foundation, which is using C3’s platform to digitize and tag 30,000 survivor testimonies, saving a decade of manual effort and millions in costs.

Equally notable is C3.ai’s claim of holding a patent on agentic AI, with more than 100 solutions already deployed. These applications span defense, manufacturing and government. Management believes this vertical alone could be worth more than the company’s current valuation.

Still, questions remain. Despite the impressive demos and high-profile deployments, many of these deals are early-stage production licenses, not recurring revenues. Investors should also be cautious about lofty projections amid broader market and geopolitical uncertainties.

What makes C3.ai’s pitch different is its pure-play focus on enterprise-AI applications rather than infrastructure or toolkits. That may give the company a lasting advantage if it can scale fast enough through expanding partnerships with Microsoft, AWS and Google Cloud.

While hype surrounds anything "Generative AI," C3.ai appears to be walking the talk. Whether it becomes a long-term leader will depend on sustained customer adoption, ecosystem execution and the elusive path to profitability.

How Does C3.ai Stack Up Against Palantir & Snowflake?

While C3.ai is leaning hard into turnkey Generative and agentic AI solutions, competitors like Palantir Technologies Inc. PLTR and Snowflake Inc. SNOW are charting their aggressive paths in the enterprise AI race.

Palantir, long entrenched in government and defense sectors, is rapidly expanding its Artificial Intelligence Platform to commercial clients. Unlike C3.ai’s pre-built applications, Palantir emphasizes custom deployments and integration flexibility, especially for data-rich industries like manufacturing and energy. Its stronghold in defense mirrors C3.ai’s PANDA deployment with the U.S. Air Force, suggesting intensifying competition in federal AI contracts.

Snowflake, meanwhile, is evolving from a cloud data platform into an AI-enabled ecosystem. With the launch of Cortex, its Generative AI service, Snowflake is helping clients build custom LLM-powered apps directly within their data environments. This integration-first approach contrasts with C3.ai’s application-first model but appeals to enterprises seeking tighter control over data pipelines.

AI’s Price Performance, Valuation & Estimates

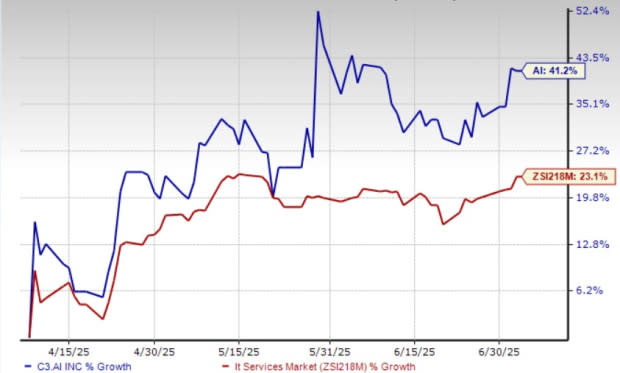

AI shares have gained 41.2% in the past three months compared with the industry’s growth of 23.1%.

Price Performance

Image Source: Zacks Investment Research

Despite the recent gain, AI is priced at a discount relative to its industry. It has a forward 12-month price-to-sales ratio of 7.12, which is well below the industry average.

P/S (F12M)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for fiscal 2026 loss per share has narrowed to 37 cents from a loss of 46 cents in the past 30 days. Moreover, the consensus mark for fiscal 2027 loss per share has narrowed to 16 cents from a loss of 42 cents in the same time frame.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

C3.ai, Inc. (AI) : Free Stock Analysis Report

Snowflake Inc. (SNOW) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research